Entrepreneur, CFO & Strategist

Lucas Roemer is the Managing Director of Roemer Capital, a boutique fundraising and investment advisory firm that also acts as an active investment vehicle. His professional journey combines entrepreneurial experience, hands-on investment expertise, and a strong track record across venture capital, investment banking, and private equity.

In addition to advising founders, Roemer Capital makes strategic investments, leveraging Lucas’s dual perspective as both an investor and advisor to support companies with capital, guidance, and operational insights.

Turning Capital into Impact

Co-Founder & CEO, Healthynox

Launched a health-tech startup and navigated the challenges of building a company from scratch. This hands-on experience with fundraising, operations, and go-to-market strategies sparked a deep understanding of what founders need—and where traditional capital support falls short.

Venture Capital Analyst, Rheingau Founders

Gained an investor’s lens on early-stage startups. Worked closely with tech founders, sharpening the ability to evaluate potential, understand scale-up challenges, and identify funding gaps. Developed the groundwork for a founder-centric investment approach.

M&A Senior Associate, KPMG

Advised high-growth companies on strategic exits and capital raises. Executed complex transactions, including the sale of LucaNet to Hg Capital. Acquired the technical tools and precision to structure deals that create real value.

Investment Professional, Main Capital Partners

Led LBOs and Buy-and-Build strategies in the B2B software space. Focused on growth, operational efficiency, and long-term value creation—further aligning financial expertise with entrepreneurial vision.

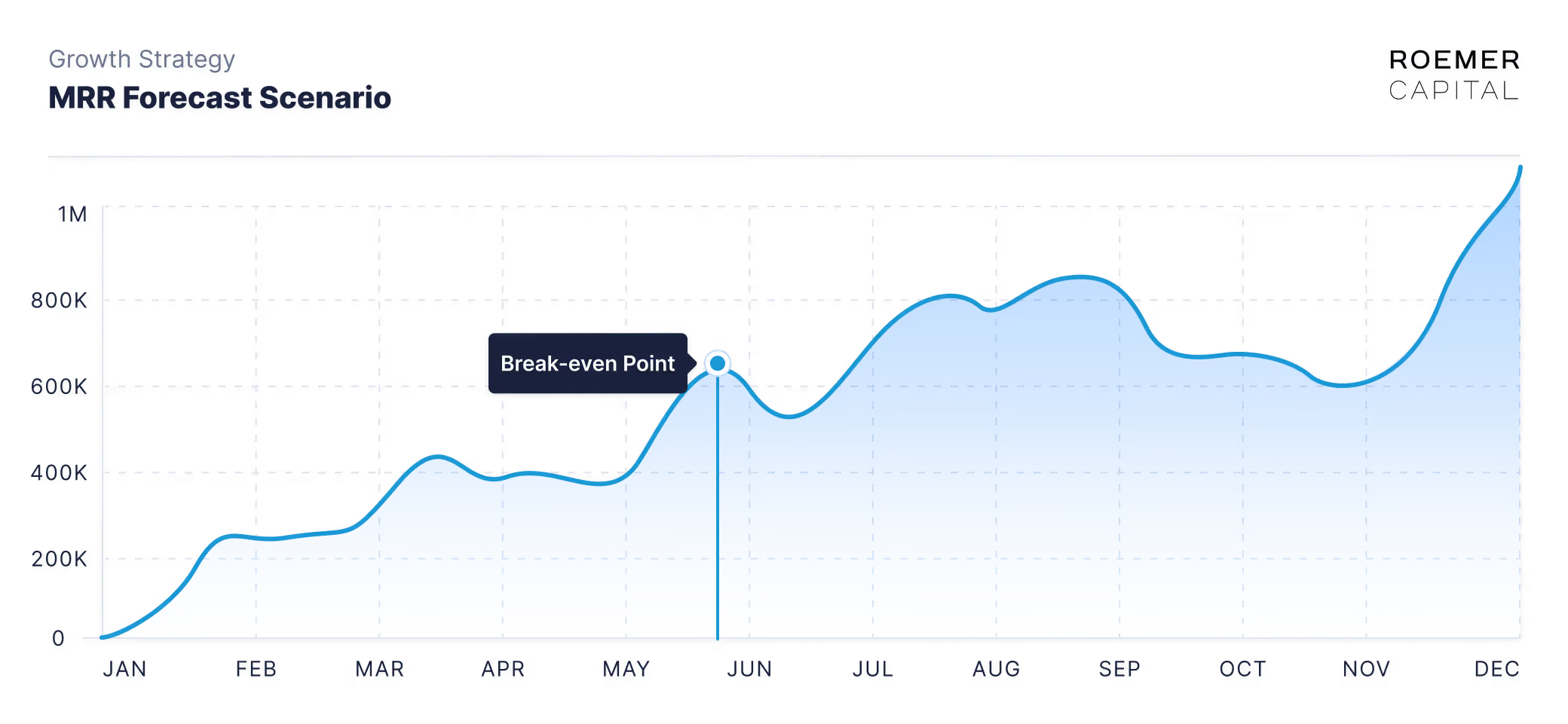

Roemer Capital

Founded Roemer Capital to help startups do fundraising the right way. With over €500M raised for clients, combines deal expertise, investor insights, and founder empathy into one goal: making fundraising faster, smarter, and more successful for tech entrepreneurs.